Sovereign CDS Auction

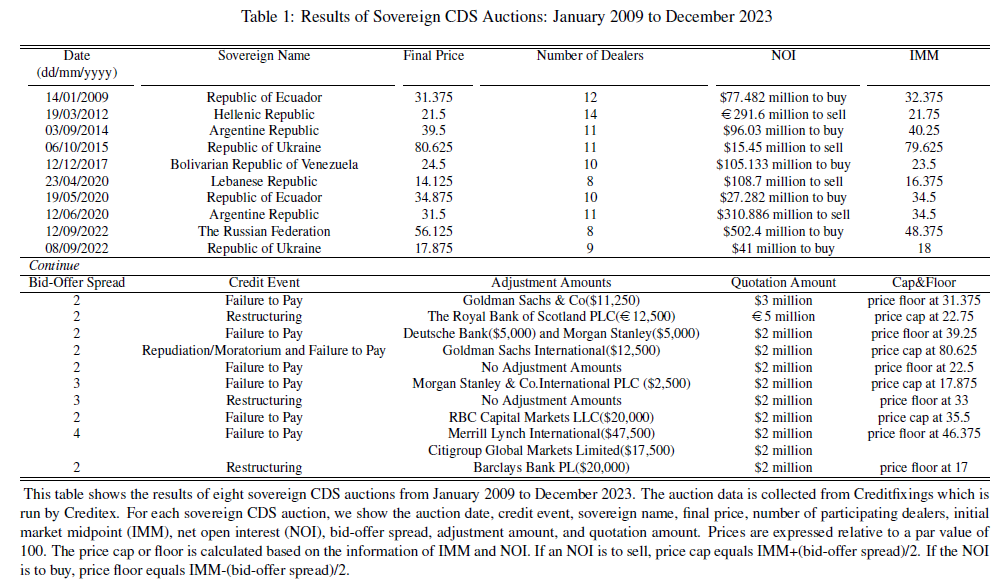

Credit default swap (CDS) auction uses a two-stage process to facilitate cash settlement following a credit event. The initial market midpoint (IMM), net open interest (NOI), and adjustment amounts are set in the first stage. The final auction price which is used for cash settling the CDS contracts is determined in the second stage. This paper studied the results of sovereign CDS auctions from January 2009 to August 2020. We find that there were on average 11 dealers in each sovereign CDS auction. 50% of the auctions had sell-NOIs. The typical credit event was Failure to Pay. The most common value of bid-offer spread was 2, while the most common value of quotation amount was $2 million. Majority of the sovereign CDS auctions contained penalties. In general, the final auction price was between 20 to 40.

Below is the results of Sovereign CDS Auctions from January 2009 to December 2023.

Paper can be found here: Sovereign CDS Auction

Sovereign CDS Trading and Manipulation

There are several ways in manipulation “naked” CDS. The first way is through demand-based price pressure. This type manipulation requires the manipulators to take large positions relative to the underlying debt amount outstanding. Therefore, if manipulation comes from the price, then: first, manipulators’ CDS position would be comparably large compared to underlying debt amount. Second, once the banning regulation is implemented, the CDS price should fall sharply. The second source of manipulation is from the misleading price information, which requires the manipulator to first short a large amount of the underlying bond, then overpay for a small amount of CDS protection. We test whether the Greek speculation is raising from the second source of manipulation. We use the Granger causality test to show the direction of information flow between the sovereign bond market and CDS market. Our hypothesis is that if the Greek manipulation is from the misleading price information, then before banning the “naked” sovereign CDS trading, Greek CDS spread changes should granger cause the Greek bond yield changes. After banning “naked” sovereign CDS trading, the changes of Greek bond yields should granger cause the changes of Greek CDS spreads. We use the first difference of the CDS data as input to get rid of the co-integration problem. We set the rejection of hypothesis as 99%.

Paper can be found here: Sovereign CDS Trading and Manipulation

Sovereign CDS Contract

Sovereign credit default swap contract, like other CDS contracts, performs similar to an insurance. The protection buyer pays premium in exchange for a contingent payment when a credit event occurs. The short-dated CDS contract is typically used as a primary trading vehicle by large institution money management firms to express their views on sovereign bonds. For emerging market, bonds denominated in specified currencies, governed by foreign law, and issued in external market are generally considered as deliverable. For standard Asian sovereign CDS contract, both bond and loan are included in the deliverable obligation category. However, the bonds or loans with sovereign lender are not considered as deliverable1. The standard specified currencies include US dollar, Euro, Swiss franc, British pound, Canadian dollar, and Japanese Yen. The Determinations Committees (DCs) of the ISDA determined whether a credit event has regional DCs: Americas, Asia Ex-Japan, Australia and New Zealand, Europe/Middle East and Africa (EMEA), and Japan. There are 15 voting members in each of the regional DC, which membership is reviewed annually.

Paper can be found here: Sovereign CDS Contract

Crude Oil Price Co-movements: A Revisit

We investigate the dependence structure among WTI, Brend, and NEX using copula models. Model is implemented using ARMA(p,q)-EGARCH(1,1)-t for the marginal distributions and five time-invariant copula models for the joint distribution. We find evidence of symmetric tail dependence. Moreover, copula results show the tail dependence between crude oil returns is stronger than the tail dependence between the returns of crude oil and new energy global innovation index. Our findings are useful for portfolio diversification and risk management.

Paper can be found here: Crude Oil Price Co-movements: A Revisit

Network Approach to Interbank Market: A Survey

The recent crisis calls for a better understanding in the interbank market. This paper surveys the recent literature, which studies the system stability under different interbank network formations. I include some stylized and important theoretical papers, which provide the economic meaning of the interbank markets, uncertainty source, and moral hazard problem under the simple network structure. I also consider the complex and dynamic network formations, where banks are strategic and not identical in terms of size and credit condition. Paper ends with a discussion of the future directions for research, which include a better understanding in calibrating the theoretical models using a more real world based network formations and a better mapping of the generic properties of the network.

Paper can be found here: Network Approach to Interbank Market: A Survey